Financial Portfolio Designer

Do a quick health check of your financials using our portfolio allocation tool

Tax planning may seem like a tedious exercise requiring lot of efforts that may make an ordinary investor nervous at the first glance. Integrity brings you a comprehensive tax solutions plans which are smartly planned for you. From personalized guidance on tax planning, calculation of tax liability, on-the-spot investment in tax saving products, and filing of IT Return, Integrity Smart Tax Solutions are answer to all your income tax related queries.

Tax saving is important, especially when investors can save up to 30,900 in taxes! Section 80C of the Income Tax Act, 1961 provides options to save tax by reducing the taxable income by up to 1 lakh.

Over the top its great if a solution offers Protection to your family as well !!

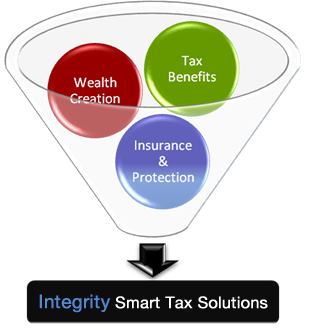

Keeping this in mind ,our Tax Savings Solutions are designed on a 3 –pronged strategy which help to reduce your tax burden and at the same time, aim to grow your money.

That's why these solutions are ideal for investors who would like to create wealth along with tax saving.

With tax planning we offer our customer a concrete approach towards tax savings, wealth creation, and protection with wide range of products to meet their future goals.

Are you looking to save some tax? Your first port of call should be Section 80C of the Income Tax Act. Section 80C provides for deduction from Gross Total Income for certain eligible investments and payments. Following is the list of instruments which can be used for Tax savings

More Details