RBI Guidelines for NRI investors

Non Resident Indian" means a person who is a citizen of India residing outside India for carrying out employment or on business or vocation.

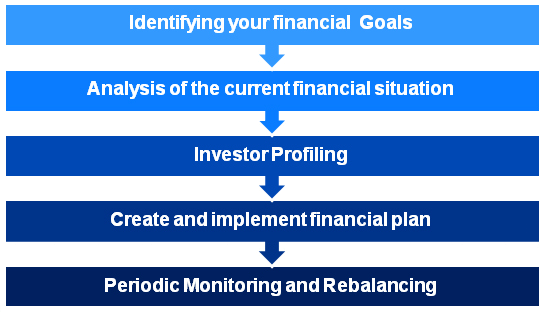

We will work towards creating financial security and stability for you through a range of financial solutions specific to your individual needs, and then making sure that the desired results are achieved through on-going conversation, active tracking, and applying appropriate corrections throughout the lifecycle.

We help you to identify various life stage responsibilities and goals to estimate the corpus required towards achieving these goals. This includes planning for various life-stage goals such as child’s education, marriage and post retirement income along with other short-term goals like contingencies or vacations. The next step is to estimate the corpus that would be required at various points in time to meet these goals. This helps you understand your financial needs in the future and prepares you for taking the necessary steps.

Once you speak to us, you will feel comfortable & strategic fit about us in your financial planning & wealth management journey .You can set up a complementary initial consultation, if you haven't already done so. From there, you'll be ready to start the financial planning process and an ongoing Advisor relationship.